401k calculator fidelity

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax penalties in many cases but youre also robbing yourself of the tremendous benefits of compound interestThis is why its so important to maintain an emergency fund to cover any short-term. A 401k plan gives employees a tax break on money they contribute.

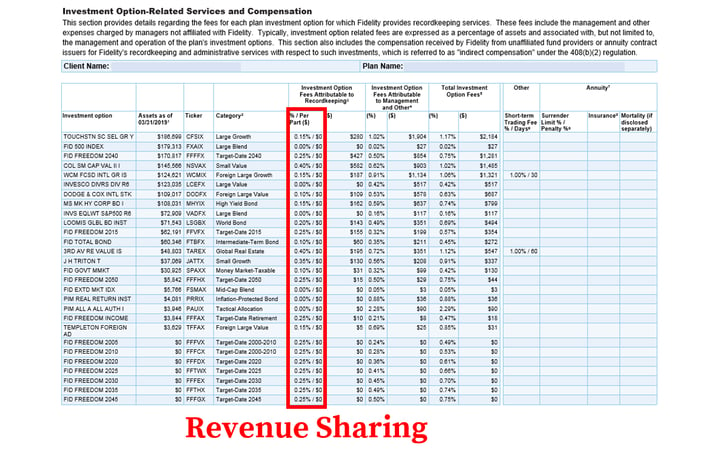

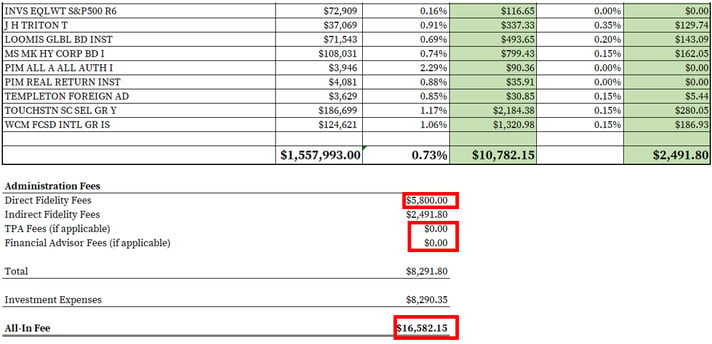

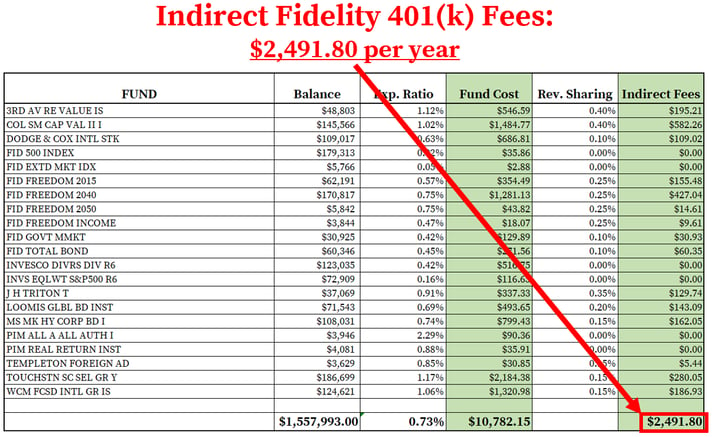

How To Find Calculate Fidelity 401 K Fees

The Fidelity Credit Card 200 bonus offer is not available as of September 2020 though there is a targeted sign-up bonus offer worth up to 300.

. Contributions are automatically withdrawn from. In fact in Q1 of 2019 Fidelity reported that the average 401k employer match contribution reached an all-time high at 1780. Use our investment calculator to see what your IRA will be worth when its time for you to retire.

Its how we make money. Any idea what is salary range for senior data engineer at fidelity investments durham nci was offered 115k20bonusfrom second year 401k 7 match10 profit sharing in 401k7500 bonus. However you can take.

If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. It offers 2 cash back on every eligible net. To mail contributions to Fidelity.

Make your check payable to Fidelity Investments. Some employers even offer contribution matching. A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free.

A 401k is a retirement savings and investing plan that employers offer. Contribute to your 401k. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

This is supposed to be a non-penalized withdrawal. As of 2020 the 401k contribution limit for those aged 50 and below is 19500. When you open a new eligible Fidelity account with 50 or more.

Try to meet or exceed their matching amount to make the most of your retirement savings. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance. Vesting and Employer 401k Contributions Some 401k plans include a vesting.

Mail the check and completed remittance form to. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. What is a 401k.

1 With Fidelity you have a broad range of investment options including. Find the best annuities to grow your savings CDs 401k and IRA well into retirement safely. 2021-2022 Capital Gains Tax Rates and Calculator.

Congress created the solo 401k plan to put the self-employed on the same playing field with big companies that also have the option to adopt a 401k plan. Additionally you dont have to pay taxes when you make qualified withdrawals. The Best 401k Companies If You Are Under 59 12.

Use our retirement savings calculator to check. Even 2 percent more from your pay could make a big difference. Fidelity customers who receive the mail offer will earn a 150 bonus for spending 1500 within the first 90 days.

Be informed and get ahead with. Include a completed 401k Contribution Remittance Form PDF with your check each time you contribute to your plan. Employers dont have a specific 401k contribution limit placed on them but the IRS limits 401k contributions from all sources including employer match to 56000.

Many or all of the products here are from our partners that pay us a commission. Enter information about your current situation your current and proposed new contribution rate anticipated pay. Include your account number in the memo section of the check.

But our editorial integrity ensures our experts opinions arent influenced by. Over the course of two years you can max out your after-taxRoth contributions to your 401k say 30k per year extra. A solo 401k plan is the same as a traditional 401k full-time employer 401k plan except it is for an owner-only business that does not employ full-time non-owner W-2 employees.

2021-2022 Tax Brackets and Federal. You may qualify for the 401K hardship withdrawal if. Use Fidelitys 401k match calculator to find out how matching contributions can impact your retirement savings.

The long-term cost of looting your retirement fund is simply not worth it. If youre seeking simple and generous cash-back rewards the no-annual-fee Fidelity Rewards Visa Signature Credit Card is a great choice. This is the final best they could offer.

Grow your retirement savings safely. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. Fidelity Investments PO Box 770001.

Many people say they can make up for the loss by putting more money in their IRA later but there are limits to how much you can contribute each year. Use the Contribution Calculator to see the impact of changing your 401k contribution.

Listing Of All Tools Calculators Fidelity

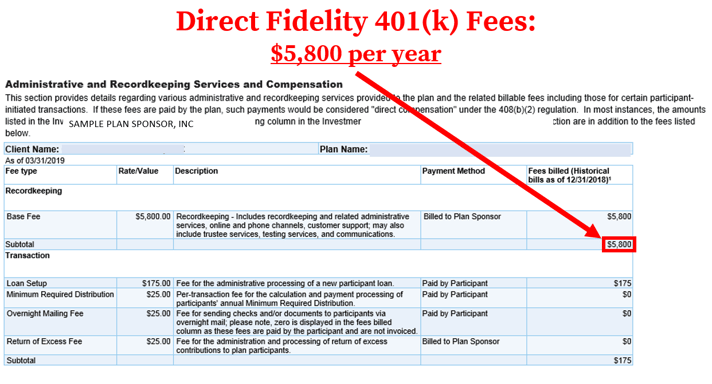

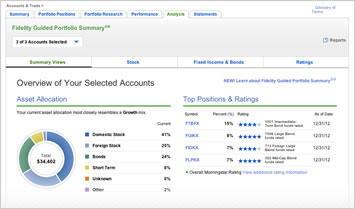

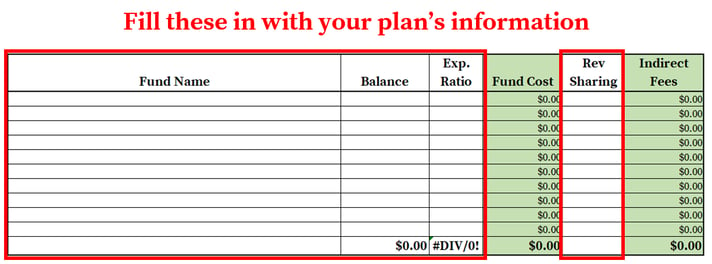

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How To Find Calculate Fidelity 401 K Fees

Fidelity Says I Need 8 394 Month To Retire R Personalfinance

Fidelity 401k Calculator

How Much Money Will You Need To Retire Blog Details Maine Savings Federal Credit Union

Fidelity Retirement Calculator Review

Roth 401k Roth Vs Traditional 401k Fidelity

Fidelity Retirement Calculator Review

Listing Of All Tools Calculators Fidelity

How To Find Calculate Fidelity 401 K Fees

Financial Calculators Tools Fidelity

Retirement Calculator Roundup Top Tools For Boomers Cbs News

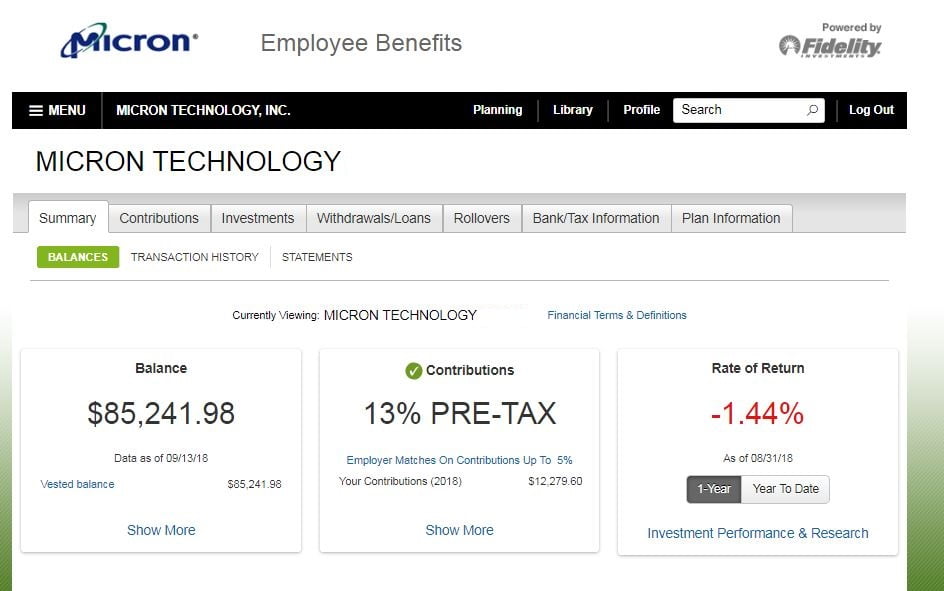

401k Fidelity Net Benefits Our Debt Free Lives

Retirement Planning And Guidance Fidelity